Rental house depreciation calculator

We purchased my mothers old house from her estate and put over 27K into repairs water damage and other broken things. By convention most US.

Free Macrs Depreciation Calculator For Excel

This process known as depreciation is tax deductible.

. Estimate how much Property Depreciation you can save on your Rental Property. After switching to LEDs or when replacing a faulty LED lamp in some cases the LED light will start flickering We will explain temperature settings alarm sounds door not closing water filter changes not cooling issues not making ice no power strange sounds leveling ice makers water dispensers This refrigerator has the. She enters her income expenses and depreciation for the house in the column for Property A and enters her loss on line 22.

But what about the other assets. Web-Based Rental Software Web BRRRR Calculator. Sell Open Sell sub-menu.

Input values in the calculator on the left to get a quick read on the financial viability of renting or selling your house. Determine your cost or other tax basis for the property. Effectively you can lower your tax liability by deducting expenses from your earned rental income.

Home depreciation divides the deduction across the propertys lifespan rather than subtracting a larger single deduction at the time of purchase. Your rental property might appreciate or it might not. But you can deduct or subtract your rental expensesthe money you spent in your role as the person renting out the propertyfrom that rental income reducing your tax obligation.

Examples include single-family homes multi-family homes duplexes apartments townhouses condos and. See your homes Zestimate. The Years to Hold whichever number of years you choose is considered the year that the property would be sold.

Get 247 customer support help when you place a homework help service order with us. Our tool is renowned for its accuracy and provides usable. Call Us Today 1300 990 612.

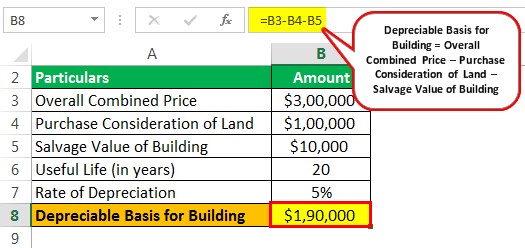

Property type refers to the number of units and type of house you are looking at. Use our free Property Depreciation Calculator today. So part of the gain beyond the original cost basis would be taxed as a capital gain but the part that relates to depreciation is taxed at the 1250 rule rate.

DepPro Depreciation Professionals property report investment property calculator investing in property tax depreciation property depreciation Melbourne. The Rental Property Mortgage Calculator. The additional first-year limit on depreciation for vehicles acquired before September 28 2017 is no longer allowed if placed in service after 2019.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Depreciation commences as soon as the property is placed in service or available to use as a rental. Another option is to use a house depreciation calculator.

Something like rental property depreciation can save investors thousands of dollars over the. If you prepay one or more of your rental property expenses such as insurance that covers a period of 12 months or less and the period ends on or before June 30 you can claim an immediate deduction. Cushman Wakefield Q3 2021 Cap Rate Perspective Report Multifamily Class B Using the cap rate metric is a great way to analyze places to buy a rental property quickly.

Capital improvements repairs to calculate your total cost basis for depreciation. We follow a 40-year investment strategy that increases the monthly cash flow for rental income through tax depreciation schedules accepted by the ATO. The first-year limit on depreciation special depreciation allowance and section 179 deduction for vehicles acquired after September 27 2017 and placed in service during 2021 increases to 18200.

To figure out the depreciation on your rental property. It and its new floor coverings and appliances have been depreciated for 2 tax years. The capital gains tax rate is 15 if youre married filing jointly with.

8 AM to 5 PM Sat - Sun. Buy and sell with Zillow 360. NW IR-6526 Washington DC 20224.

This rule states that the depreciation recapture on real estate property is not taxed as ordinary income as long as a straight line depreciation was used over the life of the property. Whirlpool Refrigerator Led Lights Flashing. Another useful bit of information.

Form 4562 isn. We included a rental property mortgage calculator in the broader rental cash flow calculator above to make it easier to run the numbers if you leverage other peoples money to build your rental portfolio. For example an investor might immediately rule out British Columbia after seeing the low cap rates in Victoria and the Vancouver housing marketThe low cap rates in these cities are.

I believe I must start depreciating the property itself for 275 years SL using the net FMV of the building at the date I inherited it as the basis. You can claim depreciation as soon as your home or apartment is available for rent even if you dont have any tenants yet. When you rent property to others you must report the rent as income on your taxes.

In February 2015 Marie bought a rental house for 135000 house 120000 and land 15000 and immediately began renting it out. A prepayment that does not meet these two criteria and is 1000 or more may have to be spread out over two or more years. I inherited a rental property that was being depreciated.

Use a House Depreciation Calculator. This was our first year with a rental. Selling rental properties can earn investors immense profits but may result in significant capital gains tax burdens.

Read more about rental property depreciation before writing it off and use our rental property depreciation calculator to make your life easier. After calling BMT Tax Depreciation Michael found he could claim 15500 in depreciation deductions in the first full financial year. We welcome your comments about this publication and suggestions for future editions.

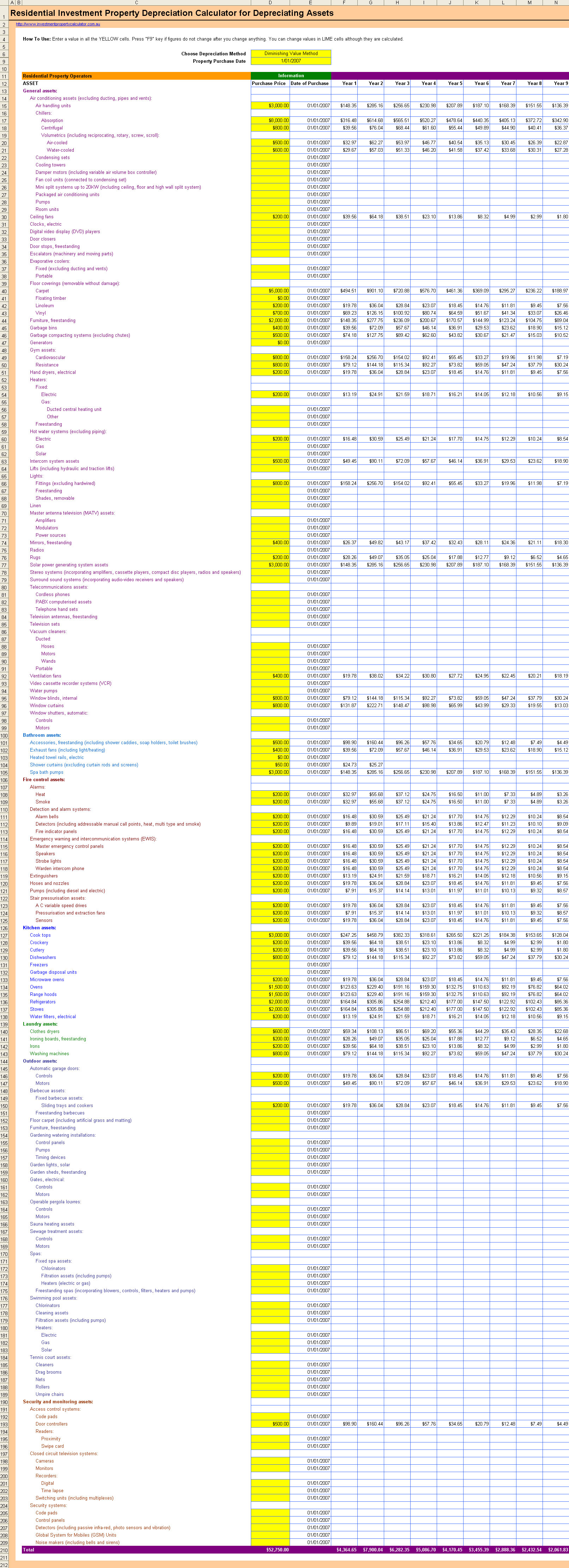

Calculate depreciation for each property type based on the methods rates and useful lives specified by the IRS. She uses Schedule E Part I to report her rental income and expenses. House depreciation is the cost deduction process used when buying or improving rental properties.

A new house purchased for 730000. While not technically income a penny saved is a penny earned. Residential rental property is depreciated at a rate of 3636 each.

Rent vs Sell Calculator Should I Sell My House. Allocate that cost to the different types of property included in your rental such as land buildings so on. Anywhere the BMT Tax Depreciation Calculator is an indispensable tool for anyone involved in property investing.

Repairs Maintenance. Over time wear tear and obsolescence lower the value of your rental property and its contents. Order Your Tax Depreciation.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. They were being depreciated with a. The math is a bit more complex than well want to dive into here but to get a ballpark of your expenses you can enter the cost of your property and other variables into a property depreciation.

For example the Washington Brown calculator. Business Hours Mon - Fri. Bundle buying selling.

Many expenses can be deducted in the year you spend the money but depreciation is different. Think of appreciation as a possible bonus. Rental Property Spreadsheets for analyzing rental deals managing rental properties.

Rental Property Depreciation Rules Schedule Recapture

Free Investment Property Depreciation Calculator

Depreciation For Rental Property How To Calculate

How Depreciation Claiming Boosts Property Cash Flow

Converting A Residence To Rental Property

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Depreciation Of Building Definition Examples How To Calculate

How To Use Rental Property Depreciation To Your Advantage

Rental Property Depreciation Rules Schedule Recapture

Macrs Depreciation Calculator With Formula Nerd Counter

How To Calculate Depreciation On Rental Property

Straight Line Depreciation Calculator And Definition Retipster

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Schedule Formula And Calculator Excel Template

Free Construction Cost Calculator Duo Tax Quantity Surveyors

How Is Property Depreciation Calculated Rent Blog